Long Term Care Insurance and Income Taxes - 2022

The new year brings no change to 2021 long term care insurance deduction limits but may see the introduction of new payroll taxes to cover state long term care funds. Learn more about new state taxes to fund ever increasing expenses for their Medicaid long term care programs, find a list of 2022 deduction limits for individual long term care insurance plans and guidance on factors that affect deductibility of long term care costs. Then, sit down with your CPA to make sure you are getting the deductions you deserve.

New Payroll Tax?

Washington state started a long term care insurance revolution in 2021. Struggling under a massive drain on the state budget due to Medicaid long term care expenses, the State Congress took a bold and controversial step. They created a trust for long term care and initiated a payroll tax to pay for it. Of course, there are many problems with the bill - and, in fact, there are currently law suits filed disputing its legality. But the fact remains that many states are facing similar devastating financial burdens due to Medicaid long term care expenses. As many as 12 states are currently considering their own legislation and are watching Washington closely to learn from their experiment.

In the state of Washington, anyone on a company payroll must pay the tax or file to “opt out” by showing proof of long term care insurance. This insurance had to be in place before November 1st, 2021. The bill was signed into law in April 2021, but most workers were not aware of its impact on their pay check until summer 2021. By then, long term care insurance companies were quickly being overwhelmed by the dramatic increase in applications. The strain on insurance company staff and resources was so overwhelming that by late summer 2021 most insurers had severely restricted or completely closed down long term care applications from Washington state.

The good news for the Washington state budget is the 2022 influx of money designated for their long term care Medicaid expenses. The bad news for Washingtonians is that older employees and those who later move out of Washington will pay into the trust but never see a dime from the Washington Cares Fund long term care money.

California is expected to be the next state to roll out some kind of tax related to long term care. Even state legislators don’t yet know what their long term care solutions will look like, but, with an aging population and already crushing Medicaid long term care budgets, the likelihood is that many states will follow Washington in the near future. Having a federally approved long term care policy in place is the best protection against the shortcomings of legislated plans.

How You Pay For Long Term Care Insurance Matters

Most people aren’t thinking about taxes when they enroll in a long term care insurance plan. But the type of insurance you buy and whether it’s individual insurance or a group plan can make a big difference in whether or not the premiums are deductible. Some tax benefits can be claimed right away (such as using Health Savings account funds to pay for premiums or making a 1035 exchange to avoid income taxes). Some tax benefits are dependent on the source of your insurance plan and your age and income. Most plans offer additional income tax advantages when you use your benefits to pay long term care bills.

The flow chart below provides an overview of the factors that might make a difference to your tax bill this season.

If you have a group plan, the company gets a deduction and you may not pay for the benefit as additional income. If you have an individual plan you may get a medical expense deduction (SEE below for more details).

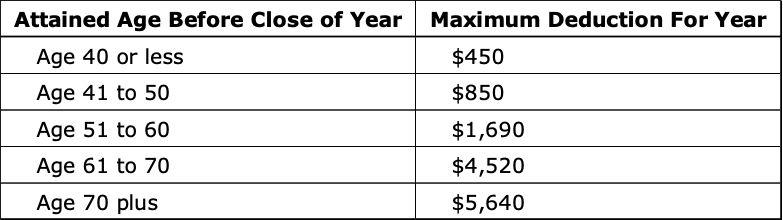

Long Term Care Insurance Tax Deductions 2022

Many people own individual long term care insurance which they pay from checking or savings accounts. Premiums for tax-qualified plans can be deducted as medical expenses up to the deduction limit for the age of the policy holder. Since the deduction can only be taken after the medical expense total is great than 7.5% of adjusted gross income, for most people this deduction becomes more valuable in retirement. The deduction limits haven’t changed from 2021 limits so if you’re filing for 2021, you can reference the same chart.

For those whose premiums are paid through a business, deductibility is determined by a number of factors but is more generous for all business entity types. (However, generally speaking, although sole proprietorships can take a company pretax deduction, the amount becomes taxable income to the individual).

Deducting Long Term Care Expenses

If you are already paying for long term care, there’s good news and bad news. The good news is that medical expenses can be deducted, but the bad news is that “palliative care” (help getting through the day – Activities of Daily Living) is not deductible. The very good news is that most long term care insurance benefit payments are excluded from income and so are not taxed!4NOTE: The information in this article is provided as general educational information only. Always consult a qualified CPA or IRS representative before making tax decisions.

Next Steps:

For advice on taxes, be sure to consult your CPA or IRS representative. Download Michael Kitces’ article for more details on how you may take better advantage of tax regulations.For advice on ways you can take advantage of tax regulations when buying long term care insurance, give us a call.